Introduction

Council tax is a pivotal source of income for local authorities in the United Kingdom, financing indispensable services like education, healthcare, and waste management. Nonetheless, some circumstances can present challenges for individuals in meeting their council tax responsibilities. This blog aims to delve into the question of how long someone can defer council tax payments in the UK, all the while examining the associated repercussions and potential remedies.

Understanding Council Tax

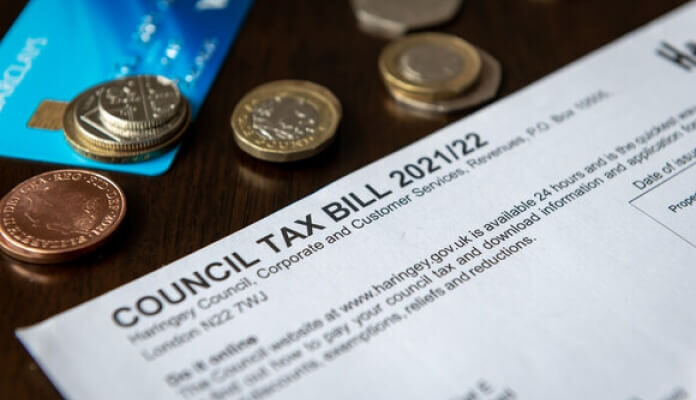

What is Council Tax?

In the United Kingdom, council tax is a local property tax levied on residential properties, calculated annually based on property value and the applicable local council tax rate. This tax plays a pivotal role in financing essential local services.

Who is Responsible for Paying Council Tax?

The person responsible for paying council tax is typically the individual who occupies the property as their main residence. This can be a homeowner or a tenant.

How is Council Tax Calculated?

Council tax is calculated based on the valuation band assigned to a property, with properties in higher bands paying more. The valuations are determined by the Valuation Office Agency in England, the Scottish Assessors in Scotland, and the Land and Property Services in Northern Ireland.

Consequences of Not Paying Council Tax

Legal Consequences

Failing to fulfill your council tax obligations can lead to legal repercussions, including potential court actions, the issuance of a liability order, and, in extreme cases, imprisonment.

Debt Accumulation

Unpaid council tax doesn’t disappear. Instead, it accumulates, leading to mounting debts that can be financially crippling over time.

Additional Fees and Charges

Local authorities can add extra fees and charges for late or non-payment of council tax, making it even more difficult to settle the outstanding debt.

How Long Can You Go Without Paying Council Tax?

Grace Period: In the UK, local authorities typically offer residents a degree of flexibility regarding council tax payments, often granting a grace period of several weeks or months to allow individuals to catch up on their payments.

Effective Communication: If you encounter challenges in meeting your council tax obligations, it is of paramount importance to maintain open lines of communication with your local authority. They may be amenable to arranging a customized payment plan to assist you in managing your debt.

Temporary Financial Hardship: In situations of temporary financial difficulty, you have the option to apply for council tax support or a reduction. This avenue can provide relief during challenging financial periods.

Long-Term Non-Payment: Prolonged failure to meet council tax obligations can have severe repercussions. After a span of several months with no payment, your local authority may initiate legal proceedings to recover the outstanding debt.

Possible Solutions

Speak to Your Local Authority

Your initial course of action, if you’re grappling with council tax payments, should be reaching out to your local authority. They may be willing to collaborate with you in designing a payment plan that aligns with your financial circumstances.

Apply for Council Tax Support

If you are on a low income or receiving certain benefits, you may be eligible for council tax support or a reduction. This can significantly lower the amount you owe.

Debt Management Plans

If you have multiple debts, including council tax, a debt management plan can help you consolidate your debts into manageable monthly payments.

Seek Professional Advice

If you find yourself in severe financial distress, it’s advisable to seek professional advice from organizations like Citizens Advice or a financial counselor. They can offer guidance and support in managing your finances.

Consider a Property Valuation Challenge

In some cases, the council tax band assigned to your property may be incorrect. If you believe your property has been placed in the wrong band, you can challenge the valuation, potentially lowering your council tax bill.

Conclusion

Although there isn’t a defined timeframe for how long one can defer council tax payments in the UK, it’s vital to grasp the ramifications of non-payment and the potential remedies. Typically, local authorities are open to collaborating with residents encountering financial hardships, underscoring the importance of engaging in dialogue with them to identify a feasible resolution. It’s worth noting that addressing council tax matters proactively is preferable, as it mitigates the risk of accumulating debt and being subject to legal action. In times of financial struggle, seeking assistance and counsel is advisable to navigate the challenging financial landscape and secure your financial stability.